Payroll tax calculation example

Small Business Low-Priced Payroll Service. So Tax Rate 15 and deduction.

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Payroll Seamlessly Integrates With QuickBooks Online.

. Get Started With ADP Payroll. The employer is liable to pay payroll tax. Payroll tax is a State or Territory based tax in Australia.

Business ABC employs only in South Australia and has taxable. Lets look at a simple example. If youre checking your payroll.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Discover ADP Payroll Benefits Insurance Time Talent HR More. Pay FUTA unemployment taxes.

The tax rate is 6 of the first 7000 of taxable income an employee. Ad Process Payroll Faster Easier With ADP Payroll. If you would like to compare upto six salaries at once side by side to see which salary has the highest take home pay use the 2022 Salary Comparison Calculator.

Employers are solely responsible for paying federal unemployment taxes. How to Calculate Payroll Tax. Step 1 involves the employer obtaining the employers.

Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier. Payroll Taxes Taxes Rate Annual. Use these calculators and tax tables to check payroll tax National Insurance contributions and student loan deductions if youre an employer.

If the salary of an employee is 2000 Birr. By referring to the above table we can see that 2000 birr falls in the No. Employers are entitled to a deduction amount which is subtracted from their wages paid.

Paycheck Manager offers both a Free Payroll Calculator and full featured Paycheck Manager for your Online Payroll Preparation and Processing needs. New taxpayer If you. Starting as Low as 6Month.

To convert a percentage to a decimal move the decimal two places to the left. All Services Backed by Tax Guarantee. Promote Your Firms Efficiency With MyCase Legal Accounting Software.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Multiple steps are involved in the computation of Payroll Tax as enumerated below. See How Workday Can Help You Improve Accuracy Efficiency and Compliance.

To calculate Medicare withholding multiply your employees gross pay for the current pay period by the current Medicare rate 145. For example if an employee makes 40000 annually and is paid biweekly divide their annual wages 40000 by 26 to get their total gross pay for the period 40000 26. Ad See How Automating Your Entire Hire-to-Pay Process Would Benefit Your Organization.

3 Months Free Trial. Ad Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. If you had a payroll tax liability in NSW less than 150000 in the previous financial year youll need to calculate your estimate by following examples 1 and 2.

Medicare Payroll Tax Example. Find The Best Payroll Software To More Effectively Manage Process Employee Payments. Payroll tax is a tax on salaries and wages.

Ad Compare This Years Top 5 Free Payroll Software. Payroll Tax Rates and Thresholds. Ad Choose Your Paycheck Tools from the Premier Resource for Businesses.

Ad Process Payroll Faster Easier With ADP Payroll. For example if the total percentage is 35 the decimal is 035. Free Unbiased Reviews Top Picks.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Ad An End-To-End Accounting Solution To Help Law Firms Keep Their Finances On Track. Then take the total tax rate as a.

Get Started With ADP Payroll.

Federal Income Tax Fit Payroll Tax Calculation Youtube

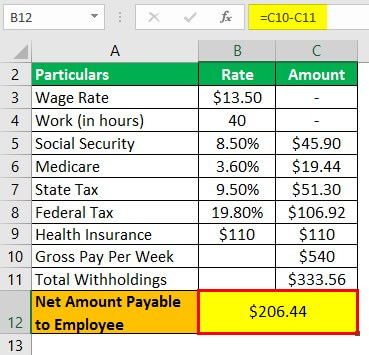

How To Do Payroll In Excel In 7 Steps Free Template

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

How To Calculate Payroll Taxes Methods Examples More

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Payroll Formula Step By Step Calculation With Examples

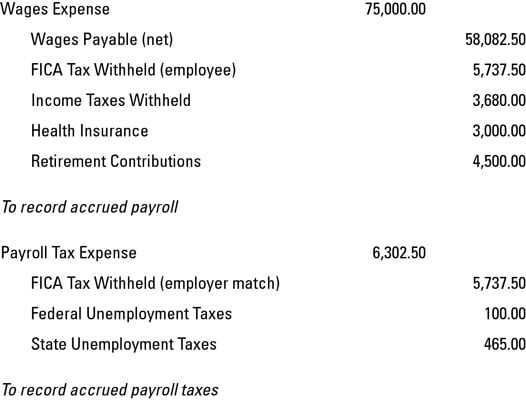

How To Record Accrued Payroll And Taxes Dummies

Payroll And Payroll Taxes Accounting In Focus

Payroll Tax What It Is How To Calculate It Bench Accounting

Payroll Formula Step By Step Calculation With Examples

Excel Formula Income Tax Bracket Calculation Exceljet

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel